Putting Roblox’s incredible $45 billion IPO in context

-

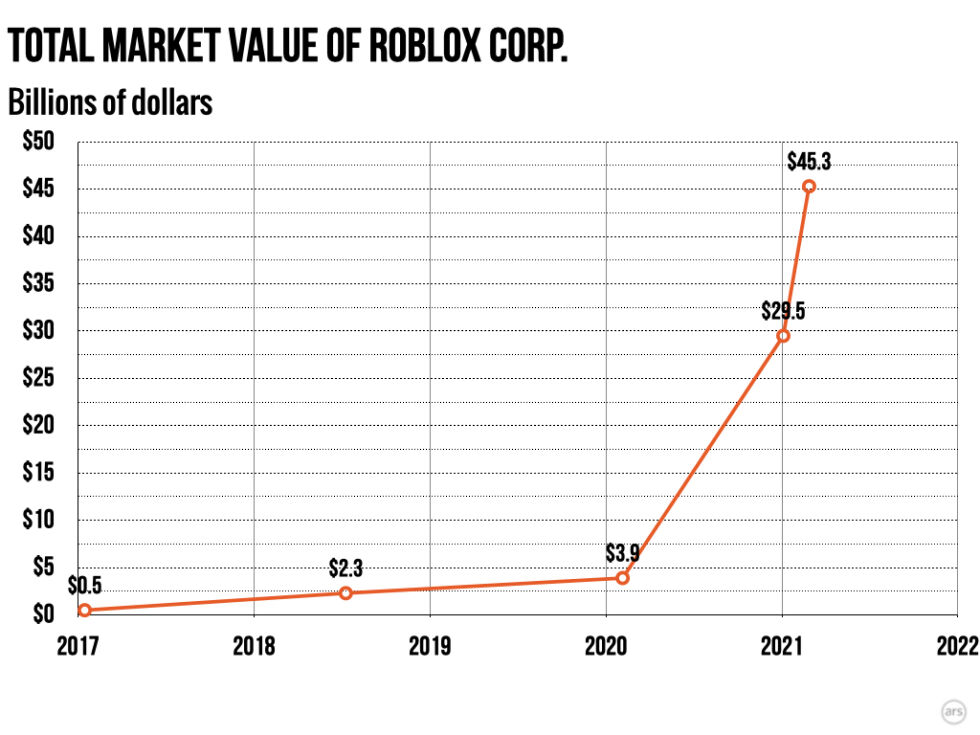

Roblox Corp.'s valuation had been rising slowly and steadily until shooting up earlier this year. [credit: Ars Technica ]

Yesterday, Roblox made good on its plans to go public, with employees and previous investors selling hundreds of millions of shares in a direct listing on the New York Stock Exchange. In a private funding round in January, those shares were worth $45. When the market closed Wednesday, they were selling at $69.50, a price that valued Roblox Corp. as a whole at $45.3 billion (as of this writing, Roblox Corp.'s stock price peaked at $77.30 and currently sits at $72.72 in Thursday morning trading).

How did this company, whose single title has become a game platform unto itself, become worth more than major game publishers like Electronic Arts and Take-Two? To help answer that question, we put together this deep dive into the numbers that are powering the Roblox revolution. They paint a picture of a company with an extremely young and incredibly engaged user base that has ballooned during the 2020 pandemic lockdowns. But Roblox is also a company that is struggling to convert its huge and growing annual revenues into profitability.

(Unless otherwise noted, numbers are sourced from SEC documents or Roblox's own website)

Read 2 remaining paragraphs | Comments

from Gaming & Culture – Ars Technica https://ift.tt/38xLHNf